When it comes to borrowing money, finding a low-interest loan can save you a significant amount of money in the long run. However, getting approved for a low-interest loan is not always easy. Lenders have strict criteria and requirements that you need to meet in order to qualify for favorable interest rates. In this article, […]

Author Archives: admin

When it comes to borrowing money, finding a personal loan with a low interest rate is essential. In the Philippines, there are numerous financial institutions offering personal loans, each with their own interest rates and terms. To ensure you get the best deal possible, it’s important to do your research and consider several factors before […]

In the Philippines, online cash loans have become a popular option for individuals who need quick access to funds. These loans offer a convenient and hassle-free way to borrow money without the need for extensive paperwork or visiting a physical bank branch. If you’re considering applying for an online cash loan in the Philippines, it’s […]

When faced with unexpected expenses or emergencies, many people in the Philippines find themselves in need of quick access to cash. Online loans with fast approval have become a popular solution for those who need immediate financial assistance. In this article, we will discuss the top 10 methods to borrow loans for emergencies in the […]

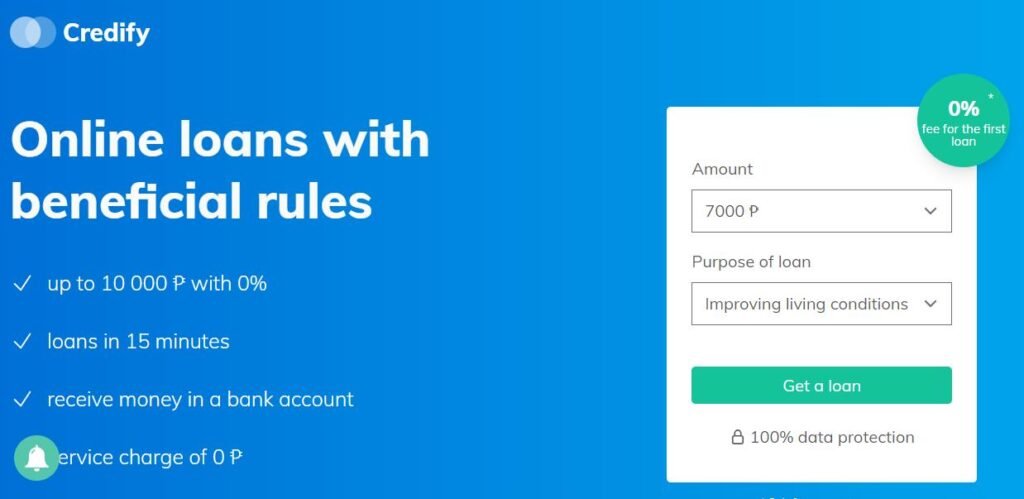

In today’s fast-paced world, financial emergencies can arise at any time. Whether it’s an unexpected medical expense, a home repair, or a sudden need for additional funds, having access to quick and convenient loans can be a lifesaver. With the advent of online lending platforms, obtaining a loan has become easier than ever before. In […]

When faced with unexpected expenses or financial emergencies, many individuals in the Philippines turn to loans to bridge the gap. However, the process of obtaining a loan can sometimes be time-consuming and tedious. In this article, we will provide you with a detailed guide on how to secure fast loan approval in the Philippines. 1. […]

When unexpected expenses arise or you find yourself in need of some extra cash, a short term loan can be a convenient and accessible financial solution. In the Philippines, short term loans have become increasingly popular due to their quick approval process and flexible repayment terms. Whether you’re facing a medical emergency, a car repair, […]

Are you facing a financial emergency and need quick access to cash? Whether it’s for unexpected medical expenses, home repairs, or any other urgent financial need, quick cash loans in the Philippines can provide you with the solution you’re looking for. In this article, we’ll explore the benefits and options available to you when it […]

MoneyCat Financing Inc. is a leading multinational fintech company that offers online payday loans in the Philippines. With a commitment to providing accessible and reliable financial solutions, MoneyCat has become a trusted name in the industry. Whether you need extra cash for emergencies, bills, or unexpected expenses, MoneyCat is here to help. MAG-APPLY MONEYCAT Why […]

Getting approved for an online loan can be a convenient and efficient way to access the funds you need. Whether you’re looking to consolidate debt, cover unexpected expenses, or fund a major purchase, taking the right steps can increase your chances of approval. In this article, we will discuss some key strategies to improve your […]