In today’s fast-paced world, financial emergencies can arise at any time. Whether it’s an unexpected medical expense, a home repair, or a sudden need for additional funds, having access to quick and convenient loans can be a lifesaver. With the advent of online lending platforms, obtaining a loan has become easier than ever before. In the Philippines, one such platform that has gained popularity is Credify Loan. Let’s explore how Credify Loan is revolutionizing the lending industry in the country.

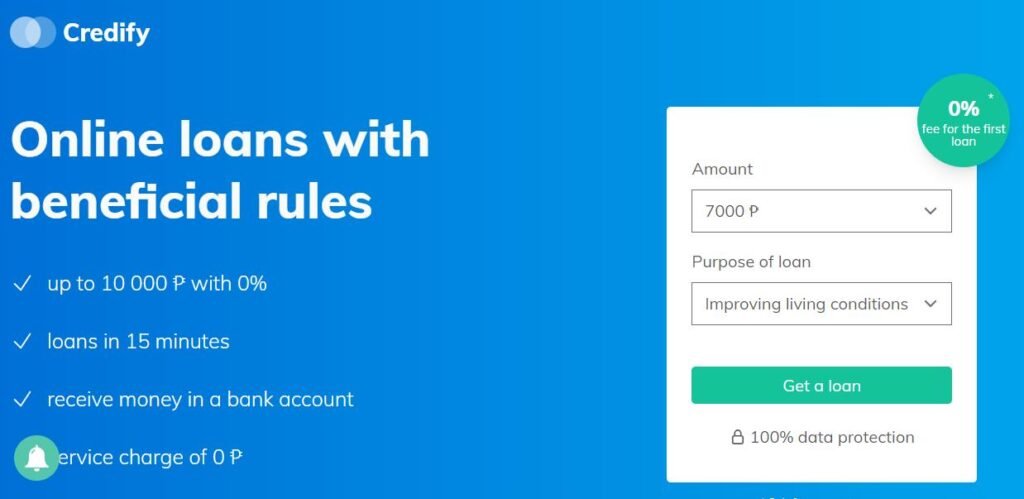

Credify Loan is an online lending platform that offers a hassle-free and convenient way for Filipinos to access loans. With a simple and user-friendly interface, borrowers can apply for loans from the comfort of their own homes. Gone are the days of long queues and extensive paperwork. Credify Loan streamlines the entire loan application process, making it quick and efficient.

One of the key advantages of Credify Loan is its accessibility. Unlike traditional banks, which may have strict eligibility criteria, Credify Loan caters to a wider range of individuals. Whether you are a salaried employee, a self-employed professional, or a freelancer, you can apply for a loan with Credify Loan. This inclusivity ensures that more Filipinos have access to the funds they need, when they need it the most.

Another notable feature of Credify Loan is its fast approval process. Traditional loans can take days or even weeks to get approved, leaving borrowers in a state of uncertainty. With Credify Loan, borrowers can receive loan approval within minutes. This quick turnaround time is a game-changer for those facing urgent financial situations. Whether it’s a medical emergency or a sudden need for cash, Credify Loan provides a reliable solution.

Credify Loan also offers flexible loan terms to suit the individual needs of borrowers. Whether you require a short-term loan to cover immediate expenses or a long-term loan for a major purchase, Credify Loan has you covered. Borrowers can choose the loan amount and repayment period that best fits their financial situation. This flexibility ensures that borrowers can manage their loans comfortably without straining their finances.

Security is a top priority for Credify Loan. The platform employs robust security measures to protect the personal and financial information of its users. With advanced encryption technology, borrowers can have peace of mind knowing that their data is safe and secure. Credify Loan also adheres to strict privacy policies, ensuring that customer information is handled with utmost confidentiality.

Customer support is another area where Credify Loan excels. The platform provides round-the-clock assistance to borrowers, addressing any queries or concerns they may have. Whether it’s clarifying the loan application process or providing guidance on loan repayment, Credify Loan’s dedicated support team is always ready to assist. This level of customer service sets Credify Loan apart from its competitors and ensures a positive borrowing experience for its users.

In conclusion, Credify Loan is transforming the lending landscape in the Philippines by offering a convenient and accessible solution for those in need of quick funds. With its user-friendly interface, fast approval process, flexible loan terms, and robust security measures, Credify Loan has become a trusted name in the online lending industry. Whether it’s for emergencies, personal expenses, or business needs, Credify Loan provides a reliable platform for Filipinos to obtain loans with ease.